Do out of state tickets affect insurance: How Florida drivers can prepare

Do out of state tickets affect insurance? Learn how they impact rates, the Driver License Compact, and steps to protect your record.

Yes, an out-of-state ticket almost always affects your Florida insurance. It’s a common and costly mistake to think a violation you get on a road trip won't follow you back home. Thanks to interstate agreements, that ticket is very likely to find its way to your Florida driving record.

Your Florida Insurance and Out-of-State Violations

Getting a ticket while traveling can definitely put a damper on your trip, but the real headache often starts when you get home. There's a persistent myth that a ticket issued outside of Florida just vanishes into thin air. The reality is that most states share driver information, meaning a violation hundreds of miles away can still add points to your license and trigger a surprise on your next insurance bill.

Let's say you get a speeding ticket in Georgia for going 15 mph over the limit while driving back to Miami-Dade County. You might be tempted to think it stays in Georgia's system, but that's rarely the case. Because of data-sharing compacts, that violation is usually reported straight back to Florida's Department of Highway Safety and Motor Vehicles (DHSMV). You can get a good overview of how states report violations to each other from Progressive.com.

Once that ticket hits your Florida record, it's treated pretty much the same as if you got it right on I-95 in Broward County.

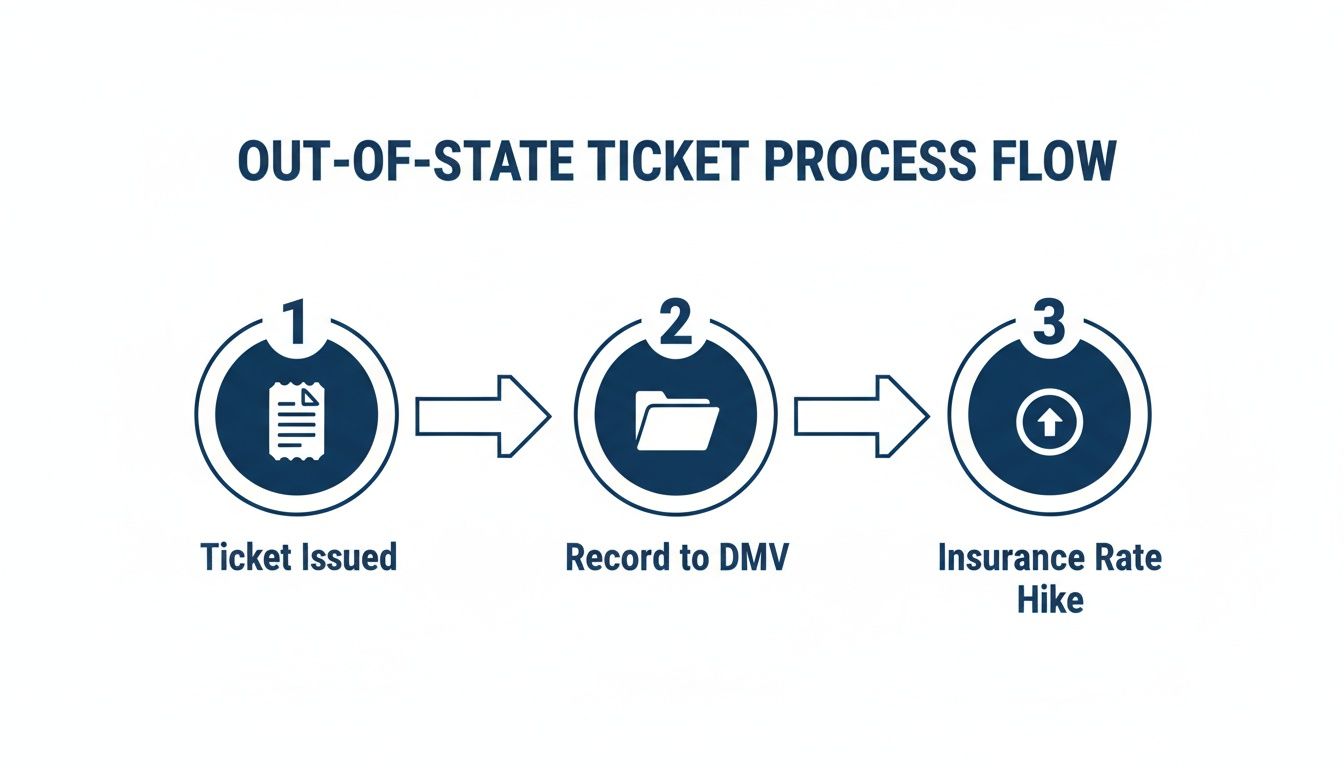

The Path from Ticket to Rate Hike

The process is a lot more direct than most drivers realize. An out-of-state violation kicks off a chain reaction that can impact your finances. The biggest problem isn't the one-time fine—it's the long-term pain of higher insurance costs. We dig into how even one ticket can affect your premiums in our article about speeding tickets and insurance rate increases in Miami.

This flowchart lays out the journey from the moment you get that ticket to when you see your insurance rates climb.

Here’s a step-by-step breakdown of how that process unfolds for a Florida driver.

How an Out-of-State Ticket Impacts Your Florida Insurance

Step | Action | Consequence for Florida Drivers |

|---|---|---|

1 | You receive a traffic ticket in another state (e.g., Georgia, North Carolina). | The initial stress and a fine to deal with. |

2 | The other state reports the violation to Florida’s DHSMV. | The violation is added to your permanent Florida driving record. |

3 | You pay the fine, which is an admission of guilt. | The conviction is now official and visible to your insurer. |

4 | Your insurance company reviews your record before your next renewal. | They discover the new conviction on your record. |

5 | Your insurer recalculates your risk profile and raises your premium. | You face higher insurance costs for the next 3 to 5 years. |

As you can see, the ticket gets reported, logged on your permanent record, and eventually discovered by your insurer—often leading to a rate hike that can stick around for years. Simply paying the fine solidifies this outcome because it's an admission of guilt. The key to avoiding these costly consequences is protecting your driving record from the very start.

How States Share Your Driving Information

It’s a common misconception: get a ticket far from home, and it won't follow you back to Florida. Decades ago, that might have been true. Today, that’s a risky and expensive assumption to make.

The reason a speeding ticket from another state can affect your Florida insurance boils down to a massive, interconnected system of information sharing between state DMVs. Two key interstate agreements create a national network that ensures what happens on the road, stays on your record—no matter where you are.

These agreements, or compacts, are precisely why a ticket issued hundreds of miles away can pop up on your Florida driving history, ready to trigger points and rate hikes. Understanding how this system works is the first step in realizing why just paying that out-of-state ticket is often a huge mistake.

The Driver License Compact (DLC)

Think of the Driver License Compact (DLC) as a national neighborhood watch program for DMVs. It’s an agreement between 45 states and the District of Columbia to report traffic convictions to a driver’s home state. The core idea is simple but powerful: "One Driver, One License, One Record."

When you, a Florida driver, get a ticket in another member state and are convicted, that state’s DMV sends the details straight to the Florida Department of Highway Safety and Motor Vehicles (DHSMV). Florida then treats that violation as if it happened right here at home, applying its own rules for penalties and points.

This system ensures drivers can't just leave their bad driving habits in another state. A serious violation in a partner state is treated with the same gravity as one that occurs on I-95.

Now, a few states like Georgia and Wisconsin aren't members. But don't get a false sense of security. Many non-member states have their own informal data-sharing deals, and the second major compact closes nearly every remaining loophole.

The Non-Resident Violator Compact (NRVC)

The other half of this powerful duo is the Non-Resident Violator Compact (NRVC). If the DLC is about sharing conviction information, the NRVC is all about enforcement. It guarantees you can't just tear up an out-of-state ticket and forget about it.

If you get a ticket in an NRVC member state and fail to pay the fine or show up for court, that state will notify the Florida DHSMV. Florida will then do them a big favor: they’ll suspend your driver's license until you fix the problem.

What it does: The NRVC forces you to deal with your out-of-state ticket.

What it prevents: It blocks you from renewing your license or registration in Florida until the issue is cleared up.

The outcome: Your license stays suspended until you can prove you’ve settled the violation with the state that issued it.

Thanks to these two compacts, your driving record is an open book to states across the country. That's why it's so important to know what's on your record and keep it clean. It’s a good habit to periodically learn how to check your driving record in Florida to make sure there are no surprises.

How Florida Processes Out of State Violations

Once the Florida Department of Highway Safety and Motor Vehicles (DHSMV) gets a violation report from another state, the geography pretty much becomes irrelevant. For all practical purposes, that out-of-state ticket is treated as if a Florida Highway Patrol trooper handed it to you right here in the Sunshine State.

Florida’s own laws and point system get applied directly to your license. The DHSMV translates that distant infraction into immediate, local consequences. It's a uniform and automatic process.

That speeding ticket you got on a road trip? It gets converted into the corresponding Florida penalty. So, if you were caught driving 16 mph over the speed limit in a partner state, that mistake will put four points on your Florida driving record. It’s absolutely no different than if you were cited on the busy roads of Palm Beach County.

Those points are the red flags your insurance company is looking for. They’re the number one trigger for rate hikes and can even lead to serious administrative penalties from the DHSMV, including a license suspension.

The Point System Conversion

The location of the ticket is far less important than the nature of the violation. The DHSMV simply matches the out-of-state violation to its Florida equivalent and slaps the corresponding points on your record. This system ensures consistency and stops drivers from dodging accountability just by crossing a state line.

To give you a clearer picture, here’s how some common out-of-state tickets get converted into Florida points.

Common Out-of-State Violations and Florida Point Equivalents

Out-of-State Violation | Typical Florida Point Assessment | Potential Insurance Rate Impact |

|---|---|---|

Minor Speeding (15 mph or less over) | 3 points | Moderate to Significant |

Major Speeding (16 mph or more over) | 4 points | Significant to Severe |

Reckless Driving | 4 points | Severe; potential policy non-renewal |

Running a Red Light | 3 points | Moderate to Significant |

At-Fault Accident | 3-4 points (depending on citation) | Significant to Severe |

As you can see, even a seemingly minor slip-up in another state can lead to serious points and a big jump in your insurance premiums once it hits your Florida record.

The core principle is crystal clear: your Florida driving record reflects your behavior behind the wheel, no matter where you are. The DHSMV and your insurer view these points as direct indicators of risk.

Understanding the real-world impact of these points is crucial. Our practice focuses on traffic and DUI defense across Florida, and our goal is to protect your license and record from these damaging additions. You can learn more about how points pile up and what they mean for you by navigating Florida's points system in our detailed guide.

From State Record to Insurance Bill

The accumulation of points is what directly answers the question, "do out of state tickets affect insurance?" When your provider runs your Motor Vehicle Record (MVR) at renewal time, they see those points without caring where they came from. To them, points are points, and they all signal increased risk.

This re-evaluation of your risk profile is what triggers a premium increase. A single out-of-state violation can lead to a surcharge that sticks around for three to five years, making that ticket a long and expensive financial headache.

The most effective way to prevent this from happening is to tackle the ticket proactively. The goal is to stop those points from ever landing on your Florida license in the first place.

So, How Does My Insurance Company Actually Find Out About My Ticket?

You might think an out-of-state ticket is your little secret. It’s not. Insurance companies don’t rely on the honor system or wait for you to confess. They have a direct, systematic pipeline to your driving history, and they check it regularly.

The key to this whole process is your Motor Vehicle Record (MVR). Think of it as your official driving report card, maintained by the Florida DHSMV. Your insurer pulls this report like clockwork to see if you're still the same safe driver they originally quoted.

This isn’t a random spot-check. It usually happens at the most critical time for your wallet: right before your policy is up for renewal. Most insurers review their policyholders' records every six or twelve months. When they pull your Florida MVR, that out-of-state violation—which by now has been converted into Florida points—is sitting there in plain sight.

From Your MVR Straight to Your Premium

Once your insurer spots that new violation, their internal calculators start whirring. In their world, a driver with a fresh ticket is statistically more likely to get into an accident. Suddenly, you look like a much bigger risk to them.

This new, higher-risk profile is all the justification they need to hike up your premium. The logic is brutally simple:

Higher Risk: New points on your record mean you’re a bigger gamble to insure.

Recalculated Premium: Your rate gets adjusted to match this new risk level.

Financial Hit: You get a much bigger bill at your next renewal.

This all happens completely behind the scenes. You won't get a courtesy call or a heads-up email. The first you'll hear of it is when that shockingly high insurance bill lands in your mailbox.

Your insurance rate is a direct reflection of your driving record. An out-of-state ticket adds negative marks to that record, and insurers will adjust your premium accordingly, often without any direct communication until the bill is due.

The Long-Term Financial Damage

This isn't just a one-and-done penalty. A rate increase from a single out-of-state ticket can stick with you for three to five years, depending on your insurance company. Imagine that speeding ticket you got on a weekend road trip from Miami-Dade County ending up costing you hundreds, or even thousands, in extra insurance payments over the next few years.

That long-term financial bleeding is exactly why just paying the ticket is almost always the most expensive choice. The initial fine is just the down payment. The real cost is in the sustained insurance hikes that follow, turning a minor mistake on the road into a major, lasting financial headache. The goal should always be to keep that violation off your record in the first place.

Strategic Steps to Protect Your Record and Insurance Rates

Getting a ticket far from home can feel like a trap. It seems like you’re stuck with two choices: either pay the fine and accept the consequences or try to navigate a court system in a state you don't even live in.

But here’s the most important thing to know: the worst move you can make is to simply pay that ticket.

Paying a ticket is a legal admission of guilt. That single action is what triggers everything else—it solidifies the conviction, kicks off the reporting process to the Florida DHSMV, and ultimately leads to points on your license and a surprise from your insurance company. There are much smarter ways to handle this.

Instead of admitting guilt, the goal should be to deal with the citation proactively to keep it from ever staining your permanent record. This is exactly where a law firm that focuses its practice on Florida traffic defense becomes so valuable.

Why You Should Not Just Pay the Fine

When you get a ticket, especially one far from home like a citation you picked up while visiting family outside Miami-Dade County, the path of least resistance feels like just mailing a check. In the long run, this is almost always the most expensive decision you can make.

The fine itself is just the down payment. The real financial gut punch comes from the insurance surcharge that can haunt you for three to five years, costing you thousands of dollars in higher premiums.

The best way to answer the question "do out of state tickets affect insurance?" is to make sure the ticket never hits your record in the first place. Your goal is to break the chain reaction before it even starts.

An attorney can dig into the specifics of your case, navigate the laws of the state where you got the ticket, and work toward a resolution that keeps your driving record clean. Our goal is to protect your license and record.

The Goal is Avoiding Points

Points are the currency of traffic violations. They are the metric the Florida DHSMV uses to track every mistake you make on the road, and they’re the justification your insurance company uses to jack up your rates. Preventing points is the absolute key to protecting your wallet.

Our strategic goals typically include:

Seeking a dismissal: We challenge the ticket based on the evidence, procedure, or any weaknesses we can find in the officer's case.

Negotiating a lesser charge: We argue to reduce the violation to something minor, like a parking infraction, which usually doesn't add points or impact your insurance.

Avoiding a conviction: We work to secure an outcome like a "withhold of adjudication," where you aren't formally found guilty of the offense.

By preventing points, you effectively sever the link between that out-of-state ticket and your Florida insurance provider. If no new points hit your Motor Vehicle Record (MVR), your insurer has no new reason to raise your rates when your policy renews. For a deeper dive, check out our guide on how to remove points from your driving record in Florida.

Our team, with an office in Broward, handles traffic matters statewide and is dedicated to protecting your license. Contact us for a free consultation to talk about the details of your out-of-state ticket and find out how we can help. Past results do not guarantee future outcomes.

Frequently Asked Questions About Out of State Tickets

Getting a ticket far from home can be a confusing mess. We get it. Below are some straight-to-the-point answers to the questions we hear most often from Florida drivers, so you can see why dealing with it the right way is so important.

Will a Ticket From a Non-DLC State Still Affect My Florida Insurance?

Yes, it’s extremely likely. While a few states like Georgia aren't official members of the Driver License Compact, they have other ways of sharing driver info with Florida. Assuming you're in the clear is a huge gamble.

Even more importantly, almost every state is part of the Non-Resident Violator Compact. This agreement ensures you can't just toss the ticket in your glove box and forget about it. If you ignore it, the issuing state will tell Florida, which can then put a hold on your license renewal.

It’s always smartest to assume any moving violation from any state can find its way back to your Florida record and hit your insurance rates.

How Long Will an Out of State Ticket Affect My Insurance Premiums?

In Florida, most insurance companies look back at your driving record for the last three to five years. If a ticket puts points on your license, you can expect your rates to stay inflated for that entire time.

While the surcharge might go down a bit each year you stay clean, the financial hit is real and it lasts. The best way to dodge this long-term cost is to fight the ticket and prevent the points from ever landing on your record in the first place.

Are the Consequences Worse for Commercial Drivers?

Absolutely. For anyone with a Commercial Driver's License (CDL), the consequences are far more severe. The standards for professional drivers are incredibly strict, and any moving violation—no matter where it happens—is a direct threat to your job.

CDL violations are reported to a national database called the Commercial Driver's License Information System (CDLIS). This means a ticket in another state can directly impact your employment and make it tough to find jobs in the future. It is critical for any CDL holder who gets a ticket to get legal help immediately.

For a CDL holder, an out-of-state ticket isn't just an inconvenience; it's a direct threat to your career. The stakes are incredibly high, and taking immediate, decisive action is essential to protect your professional future.

Is It Worth Hiring an Attorney for a Minor Speeding Ticket?

In many cases, yes. That fine you see on the ticket is just a small down payment on the total cost. A single speeding conviction can easily jack up your insurance premiums by hundreds, or even thousands, of dollars over the next few years.

When you hire a law firm, the goal is simple: avoid the points, stop the insurance hike, and save you the time and headache of dealing with it yourself. We offer a free consultation to review your ticket and lay out your options. For more general questions, you can also explore our firm's Frequently Asked Questions page. Past results do not guarantee future outcomes.

If you're facing an out-of-state ticket, don't just pay the fine and accept the consequences. Ticket Shield, PLLC can help you fight to protect your record and keep your insurance rates down. Contact us 24/7 for a free, no-obligation consultation to discuss your case. Visit us at https://www.ticketshield.com or call today.

Attorney Advertisement. Office in Broward. Submitting information does not create an attorney-client relationship.